Mastering Bank Reconciliation: An Essential Guide for Accounting Practitioners

- By Rezaul Islam

- December 04, 2024

Bank Reconciliation

Bank reconciliation is a crucial process in the world of accounting, yet it often feels like a daunting task for many practitioners. Whether you’re an experienced accountant or just starting your career, mastering this skill can significantly enhance your financial management capabilities. In this guide, we will explore the ins and outs of bank reconciliation, providing you with practical tips, techniques, examples, and insights to streamline your process and ensure accuracy in your financial records.

What is Bank Reconciliation?

Bank reconciliation is the process of comparing your company’s financial records with the bank’s statements to ensure that both sets of records match. This process helps to identify and rectify discrepancies, such as unrecorded fees, missing entries, or unauthorized transactions. Regular bank reconciliations are essential for maintaining accurate financial statements and ensuring the integrity of your accounting records.

Why is Bank Reconciliation Important?

Accuracy: Regular reconciliations help ensure that your financial records are accurate, which is vital for making informed business decisions.

Fraud Detection: By reviewing transactions, you can identify unauthorized or fraudulent activities early on.

Cash Flow Management: Understanding your cash position helps in planning and managing your business’s cash flow effectively.

Compliance: Accurate records are essential for tax compliance and financial reporting.

Steps to Perform a Bank Reconciliation

Performing a bank reconciliation involves several key steps. Here’s a detailed breakdown of the process:

1. Gather Your Documents

Before you start, collect the following documents:

Your company’s cash book or ledger

Bank statement for the period you are reconciling

Any additional records, such as invoices or receipts.

2. Compare Transactions

Begin by comparing the transactions listed in your cash book with those on the bank statement. Look for:

Deposits: Ensure all deposits recorded in your cash book appear on the bank statement.

Withdrawals: Check that all withdrawals, including checks and electronic payments, are accounted for.

3. Identify Discrepancies

As you compare the two records, you may find discrepancies. Common issues include:

Deposits in Transit: Deposits that have been made but not yet reflected in the bank statement.

Outstanding Checks: Checks that have been issued and recorded by the company but have not yet cleared the bank.

Bank Fees: Charges that may not have been reocorded in you cash book.

Errors: Forget a cheque, incorrectly record the amount, or bank incorrectly debit or credit your bank account.

4. Adjust Your Records

Once you identify discrepancies, make the necessary adjustments in your cash book. This may involve:

Adding bank fees or interest earned

Correcting any errors in your records

Noting outstanding checks and deposits in transit

5. Calculate the Adjusted Balances

After making adjustments, calculate the adjusted balance for both your cash book and the bank statement. They should match. If they do not, revisit your records to identify any remaining discrepancies.

6. Document the Reconciliation

Finally, document the reconciliation process. This should include:

The date of reconciliation

The balances before and after adjustments

A list of discrepancies and how they were resolved

Example of Bank Reconciliation:

Let’s compare the bank statement and cash ledger transactions of a company called AB, identify discrepancies between the bank and financial records, and prepare a bank reconciliation statement.

Bank Statement

Cash Book Ledger

Bank Statement

Cash Book Ledger

Identify Discrepancies

The ending balance on the bank statement as of June 30, 2024, is $35,698.00, while the company’s cash ledger shows a closing balance of $35,148. The bank statement balance is $550 more than the cash ledger balance. By comparing the two records, it is important to reconcile or adjust the identified discrepancies;

1. AB Company made two deposits of $3,800 and $3,850 against Check # 1365 and 1370 on June 17 and June 19, 2024, respectively, but these deposits did not appear on the bank statement.

2. On June 27, 2024, the company issued Check #1255 for $2,320 as a salary payment, but the bank has not yet processed it.

3. Vendor Check #1256 was issued on June 28, 2024, for $380, but it has not yet appeared on the bank statement.

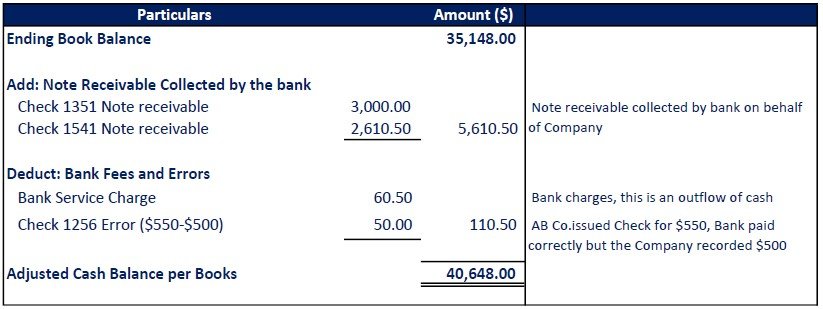

4. Check #1257 was issued for $550, and the bank correctly paid that amount, but the company recorded the check as $500.

5. A note receivable of $3,000 was collected by the bank on June 5, 2024, and another note receivable of $2,610.50 was collected by the bank on June 20, 2024. However, these amounts were not recorded in the company’s cash book.

6. The bank statement contains a $60.50 service charge for June, recorded on June 27, 2024, which was not recorded by AB Company.

Calculate the Adjusted Balances

Adjust the Balance per Bank Statement

Adjust the Balance per Cash Book Ledger

Bank Reconciliation Statement

A Bank Reconciliation Statement is a Summary of all banking and business transactions such as deposits and withdrawals that compare the company’s bank account balance with its accounting records.

Adjusted Cash Balance per Bank Statement and Adjusted Cash Balance per Books/company cash ledger should be equal.

Best Practices for Effective Bank Reconciliation

To make the bank reconciliation process smoother and more efficient, consider the following best practices:

1. Reconcile Regularly

Aim to perform bank reconciliations monthly or even weekly, depending on your business’s transaction volume. Regular reconciliations help catch errors early and reduce the workload at month-end.

2. Use Accounting Software

Investing in reliable accounting software can automate much of the reconciliation process. Many programs offer features that allow for easy import of bank statements and automatic matching of transactions.

3. Maintain Clear Records

Keep your financial records organized and up-to-date. This will make the reconciliation process much easier and help you avoid missing transactions.

4. Train Your Team

Ensure that all team members involved in the accounting process understand the importance of bank reconciliation and are trained in the procedures. This can help maintain consistency and accuracy.